These are the coolest data I have ever worked with, totally worth me working on it until now ... 3am+.

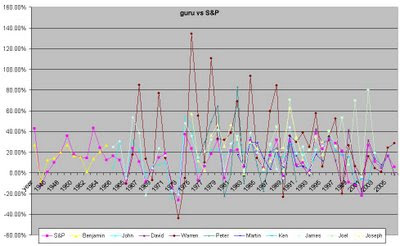

Basically these are all the greatest stock investors of all time, their actual perfomance vs Standard and Poor index ( pink line with square mark). Click on the picture on view in full size.

Graph below shows that Warren Buffet stands out quite significantly as the best profit and also worst lost ( brown line with circle mark ).

Joel seems to perform quite well most recently but the pattern is also big gain big drop ( light blue with square mark )

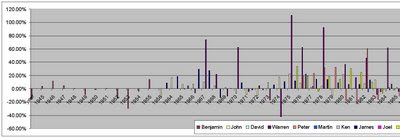

However its easier to earn profit during bull run vice versa. So the real good investor should out perform the index during good time and perserve capital during bad times. So I minus out each great investor's return with S&P return to come up with a Net Return, as an indication of how well these investors out perform the market.

Average return of all time among all greatest investors is 19.6% while the average of S&P is 13.13%. So they really out preform market by 6.46% only !

Among them, the best out preformer is Joel by 19.72% and Warren Buffet by 15.6%

How much were you thinking you can out preform market by ?

3 comments:

Interesting! May I know from where you get this data from? Are there figure of George Soros? He is long short; Buffet is long bias. I don't think Buffet is that of god-gambler at all. He has only been following the trend since 1950-60 and the markets haven't been in real bear market especially in US. Now US is going to sunk and depression. We will see how Buffet doing in the following 2 years. Rather pay more attention to George Soros type. He's a kind of attacker, take initiative. Invader, conquer. I like him

soro's style is using the rich to get richer by squeezing money out from the average. there will be an article follow thru money is evil post and warning on stock investment related to him.

buffet is well known of his miss of technology boom. so its almost a sure thing that he can no longer meet his own target. the world has advanced so much ahead that he hasn't been able to change his formula to adapt to it. His student, however, who apply the same methodology in all industries, will be the next super star when the market rises again.

Hi, (Also-Interested-For-Article-Exchange)

This is Dorothy Parker, Dear Webmaster; I thought that it is an excellent site having content related to my own site. I found your site very professional that offers excellent value to your visitors. I have noticed that you have linked to other sites and thought my website might be of interest to you and your website visitors. I am ready to give you some healthy links (both text and banner)-from-content-pages-(pr1/2/3)-of-my-websites. I have few brand new debt related articles, which I wish to post in your site.

If you are not the concerned person, then kindly forward this mail to the webmaster concerned.

Waiting for your reply.

Regards,

Dorothy Parker

Dorothy786@gmail.com

N.B: -- This message contains personal, privileged, and confidential information and is intended only for the individual named. If you are not the named addressee, you are NOTIFIED not to disseminate, distribute, re-transmit, copy, or utilize this e-mail, and contents herein. Please notify the sender immediately by return email if you have received this e-mail by mistake. You are FURTHER NOTIFIED to delete this e-mail and any attachments, as well as any copies made thereof, from your computer system(s). The sender does not accept liability for any errors or omissions in the contents of this message and unless explicitly stated otherwise, does not intend to give legal advice or enter in an attorney-client relationship.

Post a Comment