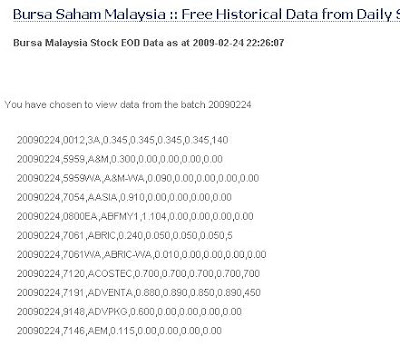

Select the latest date and you should be able to see a list of that day's stock data.

Subsequently use a spreadsheet program to filter out stocks between RM 0.10 to RM 0.50 (?) then sort the stock list by volume.

There you go ! Here is a list of stocks that you may consider !

First, find something that you understand and like, have a strong feeling about etc. For example;

You think oil price will go back up eventually, then you may want to look at KNM, Scomi, Ramunia etc.

You think Malaysia has the best resources for furniture industry - LCL.

To understand what a business does, you may check from http://biz.thestar.com.my/ Just enter the stock name at top right corner and click search !

click on the Fundamental link to view more info about this company. You may need to sign up as a member first. I think it should still be FREE.

Then, make sure the company has been strong by making sure its pass years Return on Equity are always more than 15% !!

If current stock price is below its worth, then you can buy this stock as per the assumptions made in your worth calculation method.

Don't forget the Qualitative assesment - the management. Which is very important to make sure pass year records can be repeated in future.

Lastly after passing all the criterias above, you may use trend and technical analysis to further fine tune the timing of your entry point !

====

The following has ROE >= 14% for the past 3 years :

KNM

LIONDIV PANTECH RCECAP DUFU HUAAN HSL SCOMI LCL AZRB NTPM

After analysing the EPS growth trend

and calculated their worth,

revised with latest released EPS data

there is only one stock worth buying now

KNM worth is RM 1.10 and current price RM 0.405 ( seems suspicious but lets review this in detail next )

followed by 2nd best choice

PANTECH worth RM 0.41 but current price is RM 0.455. Cann't buy now but just a small gap away.

The rest of the stocks has too big a gap between its worth and current market price so they are out for now !

One interesting stock is DUFU where I couldn't find enough data for assessment but its past 2-3 years record seems great except the most recent 2 years EPS trend downward. ( which is common to ALL businesses )

After analysing the EPS growth trend

and calculated their worth,

revised with latest released EPS data

there is only one stock worth buying now

KNM worth is RM 1.10 and current price RM 0.405 ( seems suspicious but lets review this in detail next )

followed by 2nd best choice

PANTECH worth RM 0.41 but current price is RM 0.455. Cann't buy now but just a small gap away.

The rest of the stocks has too big a gap between its worth and current market price so they are out for now !

One interesting stock is DUFU where I couldn't find enough data for assessment but its past 2-3 years record seems great except the most recent 2 years EPS trend downward. ( which is common to ALL businesses )

2 comments:

Hi, how to get access to the fundamental link? Thank you.

Hi, how to get access to the fundamental link? Thank you.

Post a Comment