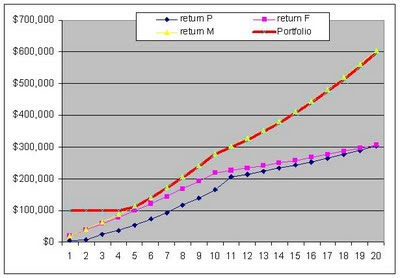

Basically it says if bad thing happens within the first 5 years, insurance is the better choice because you get $100,000+ while your FD/Mutual Fund saving is only starting to accumulate at $10,000+. However for the next 10-20 years FD and mutual fund are clearly better choices because they are more flexible and provides better returns, $300,000 and $600,000 respectively.

So the answer is to build your own portfolio !

I went back to insurance company P and asked for a Term Insurance quotation for $100,000 which costs only $313 a year for 5 years. So I minus out $313 from my yearly saving $17,920. On year 1-5, I would only save $17,607. And because I am greedy so I pick mutual fund over Fix Deposit as my saving vehicle.

Wa lah ! If I die within the first 5 years, I will get more than $100,000 which is slightly more than the insurance plan earlier - actual amount would be $ 119,016 even for the 1st year where $100,000 paid out by the Term Insurance, and the rest is from my own saving.

If I survive through the 10-20 years period, I will still have all my saving plus its earned interest !!

Best of BOTH WORLD !! Isn't it ?

This is called

Buy Term Invest The Rest

No comments:

Post a Comment