Below I share some historical trends for Stock Market, Gold and Property. They are not directly correlated but each is good enough to represend some form of global historical trend. So they are good enough as an overview and for layman entry level comparison.

Stock market

Gold

Comparison 1 - 1975 to now

Comparison 1 - 1975 to nowGold has earned 3.5x

Stock market 8x

Property 10.7x

Comparison 2 - origin to now

Gold 28x ( since 1930 )

Stock 800x ( since 1944 )

Property 16x ( since 1960 )

normalize above return by the difference in years become

Gold 35.9%

Stock 1250%

Property 33.33%

However, stock starts at 1 in 1929 and therefore give too large a gap in above comparison. So I decide to use 1960 where stock index is at 20. If I use this 20(1960) instead of 1 (1944 ) for stock, then I get

Gold 35.9%

Stock 83.33%

Property 33.33%

Gold Trend in Longer History

Comparison 3 - lowest valley to highest peak

Gold's peak at 1000 at 2007

Property peak at 181 at 1996

Stock dip to 1 in 1984

Gold 40x ( min 1923 max 2007 )

Stock 800x ( min 1984 max 2008 )

Property 22.6x ( min 1960 max 1996 )

Gold 47.62%

Stock 2352.94%

Property 62.85%

Like wise stock's number is too crazy so I use 20 instead of 1 for stock and result this:

Gold 47.62%

Stock 117.65%

Property 62.85%

==================

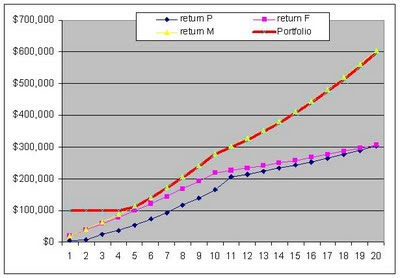

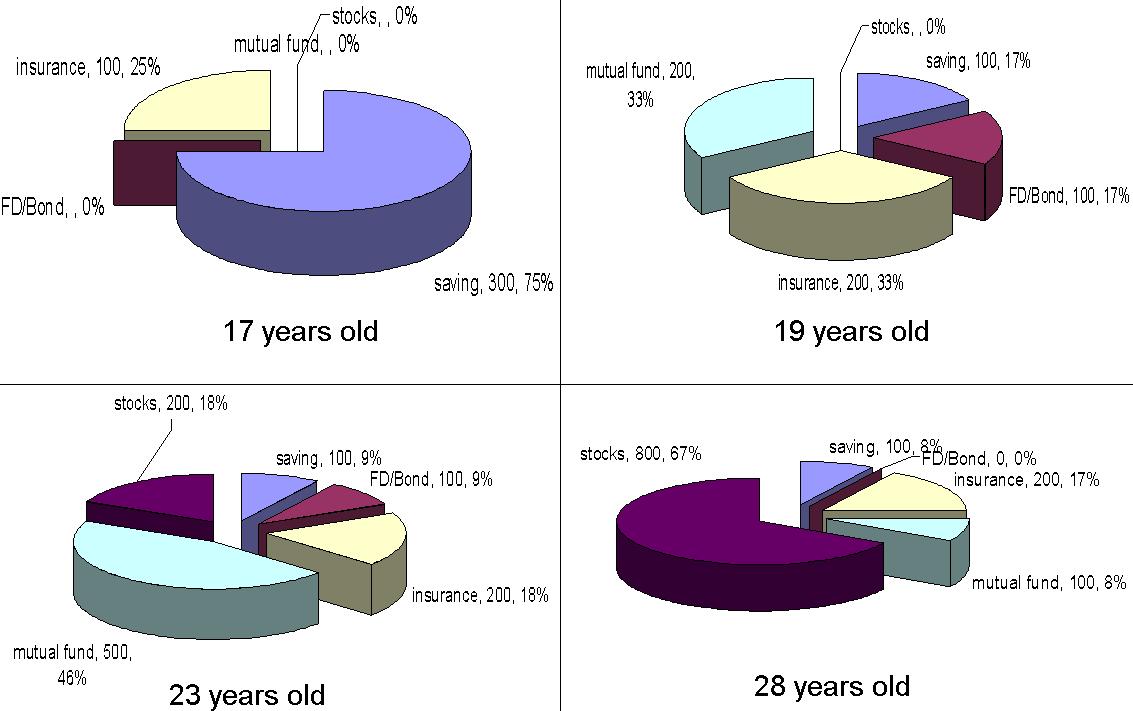

I am not too excited about any of these return rate because past performance does not guarantee future profits. However, after looking at these graph I am very excited because I think I see some repeated trends in stock market. It seems QUITE predictable from this graph alone. However, I cannot figure out any "Patterns" for Gold and Property. Therefore I am quite sure what I need to do for stock investment, but not the others.

==================

so my final word on this comparison is you should only read this for 'fun' or at most a guide only. Remember that global trend and all these 'overall' figure does NOT really affect you. Because you will NEVER buy the whole world. You will only buy a few stocks or just 1 or 2 properties. The unique buys you make for yourself determine the REAL profit for your very self. Global trend does NOT mean you have no chance to out beat it.