if you are young, you can take more risk, hence put your investment in equity.

if you are old, you should keep your capital in safer vehicle like bond etc.

List of Tax Relief for Resident Individual 2010

List of Tax Relief for Resident Individual 2010

No. | Individual Relief Types | Amount (RM) |

1 | Self and Dependent | 9,000 |

2 | Medical expenses for parents | 5,000 (Limited) |

3 | Basic supporting equipment | 5,000 (Limited) |

4 | Disabled Individual | 6,000 |

5 | Education Fees (Individual) | 5,000 (Limited) |

6 | Medical expenses for serious diseases | 5,000 (Limited) |

7 | Complete medical examination | 5,00 (Limited) |

8 | Purchase of books, journals and magazines | 1,000 (Limited) |

9 | Purchase of personal computer | 3,000 (Limited) |

10 | Net saving in SSPN's scheme | 3,000 (Limited) |

11 | Purchase of sport equipment for sport activities | 300 (Limited) |

12 | Subscription fees for broadband registered in the name of the individual. | 500 (Limited) |

13 | Interest expended to finance purchase of residential property. Relief of up to RM10000 a year for three consecutive years from the first year the interest is paid. (i) the taxpayer is a Malaysian citizen and a resident; | 10,000 (Limited) |

14 | Husband/Wife/Alimony Payments | 3,000 (Limited) |

15 | Disable Wife/Husband | 3,500 |

16 | Ordinary Child relief | 1,000 |

17 | Child age 18 years old and above, not married and receiving full-time tertiary education | 1,000 |

18 | Child age 18 years old and above, not married and pursuing diplomas or above qualification in Malaysia @ bachelor degree or above outside Malaysia in program and in Higher Education Institute that is accredited by related Government authorities | 4,000 |

19 | Disabled child | 5,000 |

20 | Life insurance dan EPF | 6,000 (Limited) |

21 | Premium on new annuity scheme or additional premium paid on existing annuity scheme commencing payment from 01/01/2010 (amount exceeding RM1000 can be claimed together with life insurance premium) | 1,000 (Limited) |

22 | Insurance premium for education or medical benefit | 3,000 (Limited) |

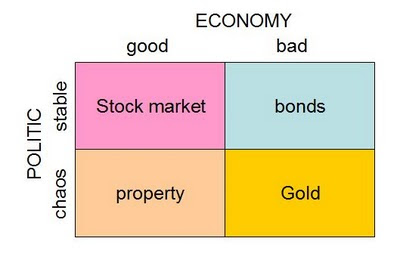

By simply moving money around depends on the political and economy situation, one was able to achieve more than 12% compound return for the past 20 years. That is equivalent to a 10X return.

By simply moving money around depends on the political and economy situation, one was able to achieve more than 12% compound return for the past 20 years. That is equivalent to a 10X return.

Leave passage

Leave passage

Leave passage within Malaysia not exceeding three times in a year and one leave passage outside Malaysia not exceeding RM3000.

Medical and dental benefit

Medical and dental benefit

With effect from the year of assessment 2008, medical benefits exempted from tax is expanded to include maternity expenses and traditional medicine like ayurvedic and acupuncture without limit.

Retirement gratuity

Retirement gratuity

The full amount of gratuity received by an employee on retirement from employment is exempt if:

i. The Director General of Inland Revenue is satisfied that the retirement is due to ill health;

ii. Retirement on or after reaching the age of 55 years/compulsory age of retirement and the individual has worked 10 years continuously with the same employer or companies within the same group

iii. The retirement takes place on reaching the compulsory age of retirement pursuant to a contract of employment or collective agreement at the age of 50 but before 55 and that employment has lasted for 10 years with the same employer or with companies in the same group.

Gratuity paid out of public funds

Gratuity paid out of public funds on retirement from an employment under any written law.

Gratuity paid to a contract officer

Gratuity paid out of public funds to a contract officer on termination of a contract of employment regardless of whether the contract is renewed or not. Compensation for Loss of Employment

Compensation for Loss of Employment

This is payment made by an employer to his employee as compensation for loss of employment either before or after the date of termination.

This compensation is exempted from tax

Compensation received by a director (not service director) of a Control Company is fully taxable.

Pensions

Pensions

Pensions received by an individual are exempt under the following conditions:

He retires at the age of 55 or at the compulsory age of retirement under any written law; or

If the retirement is due to ill health and the pension is received from the government or from an approved pension scheme.

For an employee in the public sector who elects for optional retirement, his pension will be taxed until he attains the age of 55 or the compulsory age of retirement under any written law. Where an individual receives more than one pension, the exemption is restricted to the highest pension received.

Death gratuities

Death gratuities

Monies received as death gratuity is fully exempted from income tax.

Scholarships

Scholarships

Any monies paid by way of scholarship to an individual whether or not in connection with an employment of that individual is exempted from income tax.

Income of an individual resident in Malaysia in respect of his appearances in cultural performances approved by the Minister

Income of an individual resident in Malaysia in respect of his appearances in cultural performances approved by the Minister

Money received under this category is exempted from tax on condition it is approved by the Minister.

Interest

Interest

Income in respect of interest received by individuals resident in Malaysia from money deposited with the following institutions is tax exempt with effect from 30 August 2008:

A bank or a finance company licensed or deemed to be licensed under the Banking and Financial Institutions Act 1989;

A bank licensed under the Islamic Banking Act 1983;

A development financial institution prescribed under the Development Financial Institutions Act 2002;

The Lembaga Tabung Haji established under the Tabung Haji Act 1995;

The Malaysia Building Society Berhad incorporated under the Companies Act 1965;

The Borneo Housing Finance Berhad incorporated under the Companies Act 1965

Dividend

Dividend

The following dividends are exempt form tax:

Dividends received from exempt accounts of companies.

Dividends received from co-operative societies.

Dividends received from a unit trust approved by the Minister of Finance such as Amanah Saham Bumiputra.

Dividends received from a unit trust approved by the Minister of Finance where 90% or more of the investment is in government securities.

Royalty

Royalty

Royalties received in respect of the use of copyrights/patents are taxable if they exceed the following exemption limits:

No. | Types of Royalty | Exemption (RM) |

| 1 | Publication of artistic works/recording discs/tapes | 10,000 |

| 2 | Translation of books/literary works of Education or Attomey or General Chambers | 12,000 |

| 3 | Publication of literary works/original paintings/musical compositions | 20,000 |

However, the exemption stated above does not apply, if the payment received forms part of his emoluments in the exercise of the individual's official duties.

Income Remitted from Outside Malaysia

Income Remitted from Outside Malaysia

With effect from the year of assessment 2004, income derived from outside Malaysia and received in Malaysia by resident individual is exempted from tax.

Fees or Honorarium for Expert Services

Fees or Honorarium for Expert Services

With effect from the year of assessment 2004, fees or honorarium received by an individual in respect of services provided for purposes of validation, moderation or accreditation of franchised education programmes in higher educational institutions is exempted.

The services provided by an individual concerned have to be verified and acknowledged by the Malaysian Qualifications Agency (MQA). However, the exemption does not apply if the payment received forms part of his emoluments in the exercise of his official duties.

Income Derived from Research Findings

Income Derived from Research Findings

With effect from the year of assessment 2004, income received by an individual from the commercialization of the scientific research finding is given tax exemption of 50% on the statutory income in the basis year for a year of assessment for 5 years from the date the payment is made.

The individual scientist who received the said payment must be a citizen and a resident in Malaysia. The commercialized research findings must be verified by the Ministry of Science, Technology and Environment.